Cloud Accounting – The Future

9,000+ accounting firms are already using Taxfiler and enjoying the benefits of the cloud revolution.

Connect Taxfiler to your clients to FreeAgent.

Authorisation takes a few seconds, just put in your email address and password and you can connect via the agent dashboard or if you are not a registered agent with FreeAgent, connect direct to the clients account.

Once you have connected Taxfiler to FreeAgent the connection will be remembered for as long as you need.

For details on connecting FreeAgent with Taxfiler go to our help page.

Login to your Taxfiler account

If you don’t yet have a Taxfiler account, it only takes a moment to set one up.

Taxfiler delivers all the functions of traditional desktop tax software through powerful cloud servers, ensuring a quality user experience from anywhere.

Prices start at just £10 a month for a full suite of accounts preparation and tax return production software.

Connect Taxfiler to your clients’ FreeAgent

Authorisation takes a few seconds, just put in your email address and password for FreeAgent and choose your client.

Once you have connected Taxfiler to the correct FreeAgent client, the connection will be remembered for as long as you need.

For details on connecting FreeAgent with Taxfiler go to our help page Integration with FreeAgent.

Transfer trial balance figures from FreeAgent

Taxfiler and FreeAgent have worked hard to ensure that the FreeAgent accounts will map to the correct locations in Taxfiler, avoiding the need for tedious manual adjustments.

By understanding the FreeAgent account detail types, Taxfiler is able to make intelligent choices about where figures should appear in the accounts.

And if you do need to make any adjustments, this is quick and easy using the simple editing functions in Taxfiler.

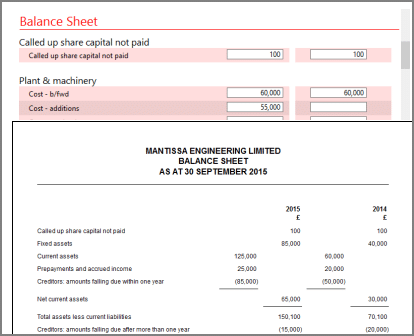

Submit your accounts to Companies House

Finalise the accounts in preparation for filing. Taxfiler allows notes and disclosures to be entered and reviewed in moments.

Once finalised and approved by the client, Taxfiler will submit accounts directly to Companies House from the accounts review page.

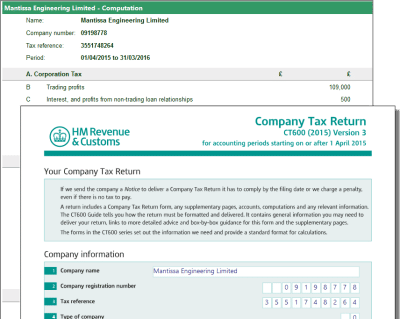

Submit Tax Return to HMRC

Make any final adjustments to prepare the Tax Return for filing to HMRC.

Once the return is finalised an IRmark is generated and the client can approve the final submission.

After submitting the Tax Return to HMRC, the electronic receipt is retrieved and stored in the Taxfiler for future use.

FreeAgent Integration

How to connect FreeAgent to Taxfiler

Connecting to FreeAgent is a simple process with all the details you need right here.

If you have difficulty connecting to FreeAgent please contact support@taxfiler.co.uk

Get Connected with Taxfiler and FreeAgent

Scroll down to see prices for Taxfiler and read more about the full set of features available with every subscription.

Find out more or Try FreeAgent for Free

About FreeAgent

FreeAgent is a UK-based award-winning online accounting software for small business owners and their accountants. Used by around 100,000 active users, FreeAgent’s accounting solution helps business owners simplify their admin and benefit from robust features including expense tracking, invoicing, bank feeds and proactive alerts.FreeAgent’s user-friendly practice dashboard allows you to run your clients’ monthly payroll in bulk and submit RTI directly to HMRC, file your clients’ VAT returns, and run reports for your public and private sector clients. FreeAgent provides free software training, help and advice from our dedicated practice support team and advice to help you grow your practice.

These monthly plans are for agents. To file a single tax return for an individual, partnership or trust, see our site for non-accountants. Click here.

Startup

£11

per month

+VAT

10 clients

Single user

Statutory Accounts

Corporation Tax

Self Assessment

- Individuals

- Partnerships

- Trusts & Estates

MTD for VAT

Bookkeeping Integrations

For startup practices

Solo

£24

per month

+VAT

(10% disc if paid annually)

30 clients

Single user

Statutory Accounts

Corporation Tax

Self Assessment

- Individuals

- Partnerships

- Trusts & Estates

MTD for VAT

Bookkeeping Integrations

Deadline Diary

For sole practitioners

Pro

£36

per month

+VAT

(10% disc if paid annually)

Unlimited clients

Multi user (£36 per user / per month)

Statutory Accounts

Corporation Tax

Self Assessment

- Individuals

- Partnerships

- Trusts & Estates

MTD for VAT

Bookkeeping Integrations

Deadline Diary

Single or multi user

Team

£236

per month

+VAT

(10% disc if paid annually)

Unlimited clients

10 users (Additional users £24 per month)

Statutory Accounts

Corporation Tax

Self Assessment

- Individuals

- Partnerships

- Trusts & Estates

MTD for VAT

Bookkeeping Integrations

Deadline Diary

Multi user

Prices quoted exclude VAT. Subscriptions are payable by monthly direct debit or PayPal.

Find out more

Quickly and easily prepare final accounts from trial balance stage, using simple manual entry or importing figures from bookkeeping software. Add notes and disclosures which will be numbered and tagged correctly. Transfer the balances seamlessly from the completed accounts to the tax return, saving time and avoiding errors. Submit iXBRL-tagged abbreviated accounts directly to Companies House at the click of a button. Includes full support for small companies, micro-entities, sole-traders and partnerships. Updated for FRS 102 and FRS 105

Quickly complete the correct forms for any accounting period. Long periods of account can be apportioned automatically across multiple accounting periods.

Generate fully-tagged iXBRL computations, complete with Capital Allowances, Chargeable Gains (including calculation of indexation) and Research & Development tax credits.

Include any required supplementary forms including Participator Loans, Group Relief and Charities. Upload PDF attachments to be submitted with the tax return.

Submit the tax return directly to HMRC using your agent credentials.

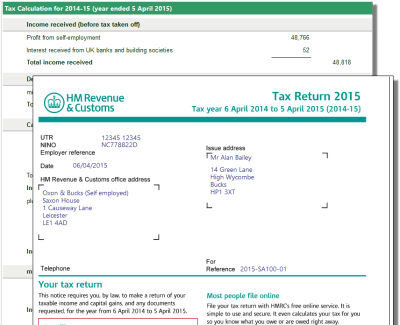

Use simple data input screens to prepare the main tax return and all supplementary forms. Transfer trade accounts directly from Taxfiler accounts preparation or import from external software. Use the built-in calculators to help with capital allowances, chargeable gains, averaging etc.

Produce detailed schedules and computations, and upload additional attachments in PDF format.

Review the tax return and prepare it for filing. Once approved by the client the return can be submitted directly to HMRC using your agent credentials, and the submission receipt will be stored as proof of filing.

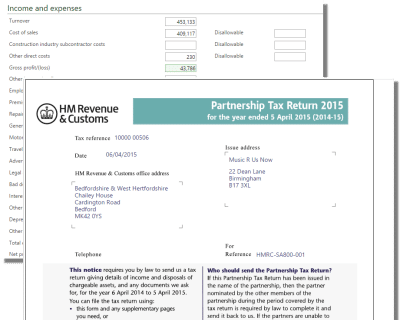

Enter details of partnership income using our straight-forward data input screens. Transfer the profit and loss account and balance sheet directly from Taxfiler accounts preparation, or import from external bookkeeping software.

Allocating profits to partners is simple, and you can link to each partner’s individual record so the data is seamlessly updated to their own personal tax return.

The partnership tax return can be submitted directly to HMRC using your agent credentials, and the submission receipt will be stored as proof of filing.

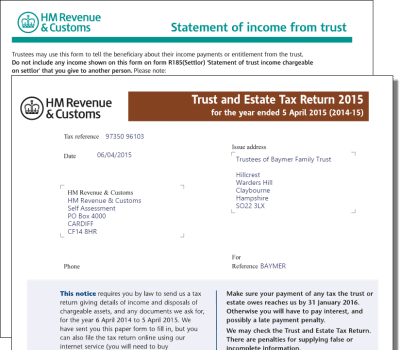

Select from a variety of trust types including charitable and non-resident trusts. Entering details of trust income and allowable expenditure is quick and easy, and you can also input details of beneficiaries and any discretionary payments made.

Taxfiler will calculate the tax payable by the trust, including any tax due on discretionary payments, and will also perform the necessary tax pool calculations.

The tax return can be submitted directly to HMRC using your agent credentials, and the submission receipt will be stored as proof of filing.

Taxfiler will also generate R185 forms containing the details of trust payments, and these can be distributed to beneficiaries as required.