Depreciation

Table of Contents

- Depreciation

- What is depreciation?

- Understanding depreciation

- Types of depreciation

- Calculation of depreciation

- Example of depreciation

- Frequently Asked Questions

Depreciation

Depreciation is sometimes mistaken to indicate that anything is merely losing value or that a computation is made for tax purposes. Although it is a complicated subject, depreciation plays a significant role in a company’s tax returns.

A fixed asset’s carrying amount is reduced ratably through depreciation. When an item’s useful life is up, its carrying value should have decreased to its salvage value, which is approximately how depreciation is designed to represent how the underlying asset is used.

What is depreciation?

Depreciation is a word used in accounting to describe the continual lowering of a fixed asset’s reported cost until the asset’s value is zero or insignificant.

Fixed assets include buildings, office supplies, furniture, machinery, etc. As the value of land increases over time, it is the single exemption that cannot be depreciated.

The anticipated life span of an asset, or how long it may be utilised, impacts the number of years it is depreciated. For instance, a laptop’s useful life is estimated to be five years.

Commodities and real estate are just two examples of the many different forms of assets. Asset depreciation is an ongoing expense while preparing your annual budget or balance sheet, unless you use a technique where the depreciable value varies annually, which will be a variable cost.

Understanding depreciation

Depreciation enables a portion of a fixed asset’s cost to be transferred to the income the fixed asset produces. Given that revenues and related costs are reported in the accounting period during which the asset is in use, this is required under the matching principle. This aids in obtaining a comprehensive view of the income generation transaction.

Businesses frequently depreciate their assets to transfer their expenses from their balance sheets to their income statements. When a business purchases an asset, it records the transaction as a credit to decrease cash (or raise accounts payable), which appears on the balance sheet. A debit is done to enhance an asset account on the balance sheet. Neither journal entry has an impact on the income statement, which contains information about revenues and costs.

Businesses must carefully consider which depreciation method will best suit their needs. The method chosen should align with the business’s financial goals and provide accurate information for financial reporting.

Types of depreciation

In accounting, there are several depreciation techniques. The following are the four primary categories of depreciation.

- Straight-line depreciation

It is one of the easiest approaches. It evenly distributes an asset’s value across several years, requiring the same payment for each year the item is used. Straight-line depreciation is calculated as follows:

Annual depreciation expenditure = (Asset cost – Residual Value) / Useful life of the asset

- Units of production method

In contrast to the straight-line approach, this involves two steps. Each unit generated in this case is given an identical expenditure rate. The procedure is extremely helpful in assembly for manufacturing lines due to this assignment. As a result, rather than using the number of years, the estimate is based on the asset’s productive capacity.

The steps are:

- First, determine the per-unit depreciation:

Per unit depreciation is calculated as (asset cost – residual value) / useful life in production units.

- Calculate the overall depreciation of the actual units generated in step two:

total depreciation expense = units produced x per unit depreciation

- Declining balance depreciation

It is a more aggressive method that accelerates the depreciation of an asset. This means that a greater portion of the cost is depreciated in the early years of the asset’s life.

Declining Balance Depreciation = (net book value – salvage value) x (1 / useful life) x depreciation rate

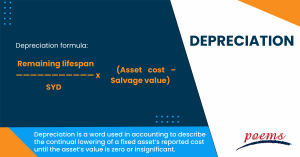

- Sum-of-the-years’-digits depreciation

It is a method that accelerates the depreciation of an asset but at a declining rate. This means that a greater portion of the cost is depreciated in the early years of the asset’s life, but the number of depreciation declines each year.

Remaining lifespan

Depreciation formula: ——————————— x (Asset cost – Salvage value)

SYD

Calculation of depreciation

The depreciation of an asset is calculated using its purchase price, expected salvage value, and estimated useful life.

When calculating depreciation, businesses can use the straight-line or declining balance method. The most popular approach is the straight-line method. It evenly allocates the cost of an asset over its useful life. On the other hand, the declining balance method accelerates the depreciation rate. This means that a greater portion of the asset’s cost is allocated in the early years of its useful life.

Example of depreciation

An example of depreciation is when a company’s factory equipment becomes outdated and needs to be replaced. The company will take a loss on the equipment, which is reflected in the financial statements.

Frequently Asked Questions

Depreciation typically has two main causes:

- One is normal and includes things like usage wear and tear, the passing of time, the expiration of a legal right in the case of some assets, and unsustainability due to technological advancement.

- The other is abnormal and includes things like accidents brought on by fire, earthquakes, floods, etc.

A depreciation expenditure directly impacts a corporation’s income statement profit. The company’s stated net income, or profit, decreases proportionally to the depreciation expenditure incurred in a particular year.

Depreciation is a non-cash item; therefore, the cost does not impact the company’s cash flow but affects accounting ratios in several ways.

- First, it reduces a company’s net worth, making it appear less profitable than it is.

- Second, it can increase the company’s debt-to-equity ratio, making it appear more leveraged and riskier.

- Finally, it can reduce the company’s return on assets, making it appear less efficient.

There are two ways to determine the valuation of a corporate asset over time: amortisation and depreciation. A tangible asset’s cost is spread out throughout its useful life using the accounting technique of depreciation. Amortisation is an accounting method used to allocate the cost of an intangible asset over its useful life.

The cost of depreciating a company’s assets over a specific period is known as a depreciation expense. On the other hand, accumulated depreciation is the amount a business has depreciated its assets.

Depreciation expense is typically recorded monthly or yearly, while accumulated depreciation is a cumulative total of all depreciation expenses incurred on an asset.

Depreciation is an important factor in determining a company’s tax liability. When a company purchases an asset, the cost of that asset is spread out over its useful life. This process is called depreciation. The amount of depreciation that a company can claim each year is deducted from its taxable income, which reduces the company’s tax liability.

Depreciation can have a major impact on a company’s tax liability. For example, if a corporation buys a new piece of equipment for US$100,000 and has a useful life of 10 years, the company can claim US$10,000 in depreciation each year. This deduction reduces the company’s taxable income by US$10,000 each year, which reduces the company’s tax liability.

Related Terms

- Unrealised Profit/Loss

- Negotiable Certificates of Deposit

- High-Quality Securities

- Shareholder Yield

- Cash Reserve

- Factor Investing

- Cash Reserve

- Open-Ended Investment Company

- Valuation Point

- Share Classes

- Front-End Load

- Tracking Error

- Replication

- Real Yield

- DSPP

- Unrealised Profit/Loss

- Negotiable Certificates of Deposit

- High-Quality Securities

- Shareholder Yield

- Cash Reserve

- Factor Investing

- Cash Reserve

- Open-Ended Investment Company

- Valuation Point

- Share Classes

- Front-End Load

- Tracking Error

- Replication

- Real Yield

- DSPP

- Bought Deal

- Bulletin Board System

- Conversion Privilege

- Capital Gains Distribution

- Fundamental Analysis

- Issuer Risk

- Net assets

- Portfolio turnover rate

- Portfolio manager

- Open-ended scheme

- Reinvestment date

- Reinvestment privilege

- Initial purchase

- Subsequent Purchase

- Fund Manager

- Target Price

- Top Holdings

- Liquidation

- Core inflation

- Direct market access

- Deficit interest

- EPS forecast

- Adjusted distributed income

- International securities exchanges

- Margin Requirement

- Pledged Asset

- Stochastic Oscillator

- Prepayment risk

- Homemade leverage

- Prime bank investments

- ESG

- Capitulation

- Shareholder service fees

- Insurable Interest

- Minority Interest

- Passive Investing

- Market cycle

- Progressive tax

- Correlation

- NFT

- Carbon credits

- Hyperinflation

- Hostile takeover

- Travel insurance

- Money market

- Dividend investing

- Digital Assets

- Coupon yield

- Counterparty

- Sharpe ratio

- Alpha and beta

- Investment advisory

- Wealth management

- Variable annuity

- Asset management

- Value of Land

- Investment Policy

- Investment Horizon

- Forward Contracts

- Equity Hedging

- Encumbrance

- Money Market Instruments

- Share Market

- Opening price

- Transfer of Shares

- Alternative investments

- Lumpsum

- Derivatives market

- Operating assets

- Hypothecation

- Accumulated dividend

- Assets under management

- Endowment

- Return on investment

- Investments

- Acceleration clause

- Heat maps

- Lock-in period

- Tranches

- Stock Keeping Unit

- Real Estate Investment Trusts

- Prospectus

- Turnover

- Tangible assets

- Preference Shares

- Open-ended investment company

- Ordinary Shares

- Standard deviation

- Independent financial adviser

- ESG investing

- Earnest Money

- Primary market

- Leveraged Loan

- Transferring assets

- Shares

- Fixed annuity

- Underlying asset

- Quick asset

- Portfolio

- Mutual fund

- Xenocurrency

- Bitcoin Mining

- Option contract

- Inflation

- Cryptocurrency

- Options

- Fixed income

- Asset

- Reinvestment option

- Capital appreciation

- Style Box

- Top-down Investing

- Trail commission

- Unit holder

- Yield curve

- Rebalancing

- Vesting

- Private equity

- Bull Market

- Absolute Return

- Leaseback

- Impact investing

- Venture Capital

- Buy limit

- Asset stripper

- Volatility

- Investment objective

- Annuity

- Sustainable investing

- Face-amount certificate

- Lipper ratings

- Investment stewardship

- Average accounting return

- Asset class

- Active management

- Breakpoint

- Expense ratio

- Bear market

- Annualised rate of return

- Hedging

- Equity options

- Dollar-Cost Averaging (DCA)

- Due Diligence

- Contrarian Investor

Most Popular Terms

- Trade sizing

- Cumulative total return

- Inactive stock

- Proportionate basis

- PATMI

- Budget Deficit

- Redemption

- Absolute Advantage

- Optimal portfolio

- Weighted average maturity

- Ex-dividend date

- Leverage

Other Terms

- Take-Profit Order

- Open Position

- Trading Platform

- Annual Percentage Rate

- Debit Balance

- Excess Equity

- Prime Money Market Fund

- Tax-Exempt Money Market Fund

- Hypothecation

- Variable Rate Demand Note

- Core-Satellite Strategy

- Fiduciary Duty

- Overlay Strategy

- Long/Short Strategy

- Strategic Asset Allocation

- Take-Profit Order

- Open Position

- Trading Platform

- Annual Percentage Rate

- Debit Balance

- Excess Equity

- Prime Money Market Fund

- Tax-Exempt Money Market Fund

- Hypothecation

- Variable Rate Demand Note

- Core-Satellite Strategy

- Fiduciary Duty

- Overlay Strategy

- Long/Short Strategy

- Strategic Asset Allocation

- Tactical Asset Allocation

- Value Fund

- Load Fund

- Fund Family

- Short ETF

- Sector ETF

- Passive ETF

- Active ETF

- Unsecured Bond

- Government Bond

- Floating Rate Bond

- Exotic Currency Pair

- Commodity ETF

- Gearing

- Variable Rate Bond

- Growth Stocks

- Treasury Bond

- Scalping

- Subordinated Bond

- Devaluation

- Stop-Loss Order

- Ticker Symbol

- Extrinsic Value

- Defensive stock

- Moneyness

- Cum dividend

- Cash Secured Put

- Naked Put

- Consumer Stock

- Call Options

- Closing Transaction

- American Options

- Capped Indices

- Bought-deal underwriting

- Board Lot

Know More about

Margin Trading

Bond Trading

Securities Lending

Supplementary Retirement Scheme

Money Market Funds

REITs ETF

Singapore Stocks

Opening Investment Account

Forex Trading

Option Trading

CFDs

Buying Unit Trusts

Treasury Bonds

Robo Advisor

Online Investing

Tools/Educational Resources

Sti components

Indices

Bond screener

Market Watch

Morning Note

Thematic portfolio

Economic Calender

Market Journal

Money Talk

Market Call

Stock Research

Fund screener

Etf screener

Investment Seminars

FAQs

Markets Offered by POEMS

SGX

PSE

ASX

KRX

SET

BIST

HNX

HOSE

NYSE

HKX

IDX

LSE

TWSE

FWB

TSE

NYSE

NASDAQ

US Asian Hours

BURSA

China A Shares

China B Shares

Euronext Paris

Euronext Lisbon

Euronext Amsterdam

Read the Latest Market Journal

Japan’s Economic Renaissance: Record Highs & Promising Sector Performances in 2024

Key highlights In 2024, Japan’s stock market experienced a remarkable rebound, with the Nikkei225 hitting...

Weekly Updates 21/10/24 – 25/10/24

This weekly update is designed to help you stay informed and relate economic and company...

Explore Opportunities with Free SGX Enhanced Market Depth! Stay ahead of the competition with real-time market insights

Summary: Market Depth is a powerful tool for retail stock investors, that provides real-time insights...

Weekly Updates 14/10/24 – 18/10/24

This weekly update is designed to help you stay informed and relate economic and company...

Weekly Updates 7/10/24 – 11/10/24

This weekly update is designed to help you stay informed and relate economic and company...

2024 US Elections and the Stock Market: Strategies for Capitalising on Volatility with CFDs

The 2024 US Elections are anticipated to have a substantial impact on the stock market,...

Unlocking Investment Opportunities with Fractional Shares and Thematic Portfolios

In today’s fast-paced financial landscape, young investors are increasingly presented with opportunities to invest and...

Weekly Updates 30/9/24 – 4/10/24

This weekly update is designed to help you stay informed and relate economic and company...

Latest Videos

Strategy & Stock Picks 4Q2024 - Singapore Market

Weekly Market Outlook: Zixin Group, Pacific Radiance, Tech Analysis, US Sectors & More!

【辉立周末报】中国新政详解 哪些版块值得关注?|油价下行 沙特出怪招? 是危是机? |辉立证券香港董事 - 黄玮杰先生(Louis Wong)、唐宇欣

Beginner's Blueprint: Unlocking the Potential of MT5 and US Pre-market in POEMS

Beginner's Blueprint: Unlocking the Potential of MT5 and US Pre-market in POEMS

23092024 Live Weekly Technical Analysis on Stocks

Follow us

![]()

![]()

![]()