Companies constantly need funds and, for the same, draw loans or register liabilities. In simpler terms, a liability is a financial obligation that a company commits itself to for growth and various other activities.

Let’s read more about liability, its types, importance and more.

You will Learn About:

What is a liability?

Liability is a financial obligation that an individual or corporation owes. It can be an obligation of money or services to a third party. Liability examples include loans (short-term and long-term), bonds, accounts payable, warranties, and more.

Liabilities, or drawing loans, may be considered a necessary evil and typically come with costs, mostly in the form of interest. However, they should not be viewed from a negative lens. Liabilities can, in fact, help companies meet their day-to-day obligations, aid expansion and accelerate growth. However, if not appropriately handled, they can cause major issues such as a reduction in financial performance or even bankruptcy.

Liability – Quick Highlights

- A liability is an obligation that has to be met or settled by transferring economic benefit in the form of money, goods or services. In accounting terms, liabilities are amounts owed to third parties.

- Liabilities are either current or not current depending upon the expectation of their settlement by the company.

- Current liabilities are debts due within a year, whereas non-current (long-term) liabilities are debts due over a longer period.

How do liabilities work?

A liability is a financial obligation.

Liabilities are a vital component for many firms as they may be required to fund day-to-day operations or aid issues like expansion. Liabilities can be classified as current or not current depending on when they are intended to be settled. It can arise on account of a previous transaction that has not yet been completely settled or can be due to obligations of future services owed by the company.

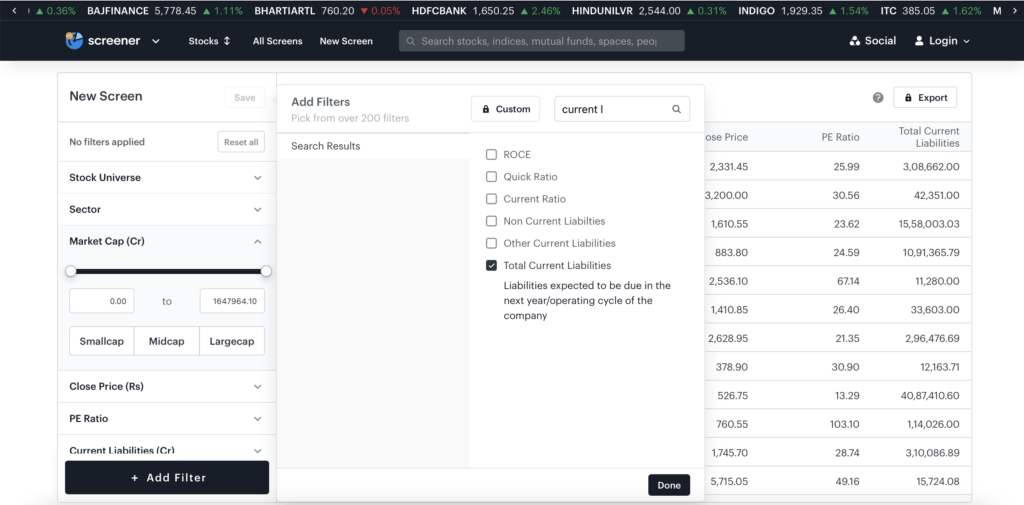

Use Tickertape to find the liabilities of a company. Open the Stock Screener, click on ‘Add Filter’ and select ‘Liabilities’.

Types of Liabilities

- Current liabilities

Current liabilities are those that are payable within a year. Corporates draw such liabilities regularly to fund their day-to-day activities. It is vital to manage these liabilities while keeping in mind the company’s liquidity and financial position. Short-term liquidity can be calculated as a ratio of current assets to current liabilities.

Current liabilities examples include payroll expenses and accounts payable, monthly utilities, wages payable, interest payable, dividends payable, unearned revenues, liabilities of discontinued operations and more.

- Non-current (long-term) liabilities

Non-current liabilities or long-term liabilities are those due after more than a year or are expected to be settled after a year. Analysing long-term liabilities is essential for understanding a company’s envisioned liquidity and capital structure.

Examples of non-current liabilities include bonds payable, long-term debt, etc.

How are current liabilities different from long-term (non-current) ones?

Current and non-current are the two forms of financial obligations a company may have. They mainly differ based on the time frame within which they must be repaid.

Current liabilities are those that must be paid within one year, like accounts payable, taxes etc. In contrast, non-current liabilities are those liabilities which are due in more than a year and can include long-term debts, leases and more.

Example of liabilities

Some examples of liabilities are mentioned below:

Current liabilities examples

- Wages payable

- Accounts payable

- Dividends payable

- Unearned revenues

- Income taxes payable

Non-current liabilities

- Bonds payable

- Post-employment benefits

- Deferred tax obligations

- Mortgage Payment/long-term debt

- Warranty liabilities

- Capital leases

Liabilities vs assets

A balance sheet can be divided into two categories – assets and liabilities.

A company’s assets are its resources, which hold monetary value and are used to fulfil the financial objectives of a company. Assets create value for an organisation and help generate income. Liabilities, on the other hand, are financial obligations that come with a cost and need to be repaid in a set time frame. This can include the amount owed to third parties, short-term and long-term debts etc.

A company having a large number of assets is a positive sign, whereas high liabilities can be a red flag depicting liquidity risk. In extreme cases, if the liabilities exceed assets, it can force the company into bankruptcy.

The connection between liability and asset can be stated as follows:

Owner’s Equity = Assets – Liabilities

This accounting equation is expressed as follows:

Assets =Liabilities + Equity

Liabilities vs expenses

| Differences | Liability | Expenses |

| Definition | A liability is an obligation or debt that a firm incurs to continue its operations smoothly. There are both long-term and short-term liabilities. | An expense is essentially a cost borne by a firm or money spent in order to generate income from the sale of its goods or services. |

| Timing | One of the characteristics of liabilities is that they must be paid within one accounting year or over several accounting periods. | Because the goal of expenses is to earn revenue for the current period, they must be paid as they are incurred. |

| Income and balance sheet | The balance sheet accounts for its business capital, assets, and liabilities. | The income statements include expenses. |

How do liabilities relate to assets and equity?

Accounting formulas are used to determine a company’s finances in the form of assets, liabilities, and owner’s equity. It can assist you in determining a company’s true financial position.

The following is the accounting formula for liabilities –

Liabilities = Assets – Equity

If a company increases its liabilities without increasing its assets, the value of the company can depreciate or experience a fall.

What is contingent liability?

A contingent liability arises when an entity foresees expenses as an outcome of an uncertain future event. It may be a prospective loss or liability that may occur in the future due to a specific event. A contingent liability has to be documented if the contingency is likely to happen, and the liability amount may be reasonably calculated.

Lawsuits, policy changes etc., can be apt examples of contingent liability.

What are examples of liabilities that individuals or households have?

Just like assets and liabilities are clearly differentiated in a balance sheet, a typical household also can follow the same method. Liabilities for the majority of households will include

- Bills due

- Payments of home loan, rent or mortgage

- Interest on loans drawn

- Education fee

- Miscellaneous expenses

Conclusion

Liability is a debt or loan drawn by a company, at a cost, repayable in a set time. Assets and liabilities are present in the financial reports generated by companies. To understand businesses and their functionings, you need a thorough understanding of assets and liability. This can help you make sound investment decisions and assess a company’s health. Use Tickertape Stock Screener which helps you find the assets, liabilities and more about a company.

FAQs

Did you Like the Explanation?

Authored By: